Property prices rise in March

Almost all of China's major cities posted a robust monthly increase in property prices in March, despite the country's latest round of tightening measures.

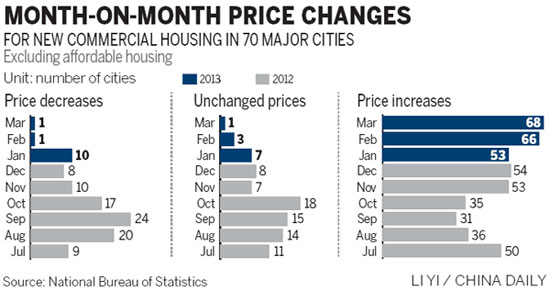

Of the 70 major cities monitored by the National Bureau of Statistics, 68 saw new home prices rise month-on-month, compared with 66 in February, the bureau said on Thursday.

Wenzhou in Zhejiang province was the only city on the list to experience a price dip last month.

Key cities reported the biggest monthly increase, with Shanghai's 3.2 percent growth topping the list, followed by 2.8 percent in Shenzhen and 2.7 percent in Beijing.

The situation was virtually the same on a yearly basis, with 67 cities registering annual increases last month, up from 62 in February.

First-tier cities led the trend, with Beijing and Guangzhou recording the highest year-on-year increase of 11.2 percent.

"Expectations of higher home costs after the implementation of the government's latest measures contributed to a purchase rush in March, which prompted property developers to either cancel discounts or hike prices," said Liu Jianwei, a senior statistician with the bureau.

Moreover, March is traditionally a peak season for housing sales, adding to the market heat, Liu said, adding that prices are likely to stabilize in April as the government's latest round of tightening begins to kick in.

The central government said on March 1 that it plans to introduce a 20 percent capital gains tax and higher down payments and mortgage rates for second-home buyers in cities where prices are deemed to be rising too fast.

Major cities have unveiled detailed regulations following the introduction of the State Council's measures to cool the real estate market. In general, among detailed regulations released by local governments, with the exception of Beijing, the measures lack severity, clarity and enforceability.

"This also means that local governments are still leaving room for decision-making and flexibility in this round of property curbs while the central government has no intention of depressing all property markets with the use of 'one-size-fits-all' measures," said Frank Chen, executive director of CBRE Research.

Home price growth is expected to gradually slow and transacted volume is expected to fall as well, according to Chen.

"Rising transaction costs may change buyers' perspectives, and force them to switch to a wait-and-see strategy in the near future," said Chen.

"But taking into account the slowdown in the land market in 2011 and the first half of 2012, new housing supply in the short term is expected to remain limited while the risk of price declines due to oversupply is very small."

Meanwhile, if house prices in some cities continue to rise rapidly in the next period, further tightening policies should be expected from local governments, he added.

Beijing has released the strictest measures due to the surge in home prices since 2012, which include limiting single adults with a registered permanent residence to the purchase of only one apartment, as opposed to two previously, and the government will also not grant sales licenses to projects priced "much higher" than the average rate in the region.

"Beijing's measures can also be used as a framework for policy upgrading among other cities in the event of prices further increasing," said Chen.

William Kwok, director of Cheung Kong Real Estate Ltd, said the government's latest round of tightening measures have had an impact on the new housing market.

The company will put 100 villas in Beijing's Shunyi district on sale around the end of April, offering fewer discounts this time, according to Kwok.

"In that case, our sales price may increase 3 to 5 percent compared with previous sales we launched in October," said Kwok. "And our sales revenue this year is expected to exceed 3 billion yuan, the highest for the past three years."

Richard Ho, head of National Real Estate Industry with Deloitte China, said prices will rise, but only moderately, in the coming month, as a reflection of government policies.

"The property market is on the way to recovery in terms of prices and sales, but investment, new construction and land markets remain cautious and inactive," Ho wrote in a report published on Thursday.

Gary Fung, a tax partner with Deloitte China, said: "It's unlikely that the Chinese government will throw down the gauntlet and not control property prices. But at the same time, policies do not seem to have been substantively tightened."

《Property prices rise in March》永久阅读地址: http://91kudian.com/yingyu/17290/

已有0条评论,点击查看发表评论